Value Add

We are a specialist provider of debt financing solutions globally to companies and projects with a nexus to Singapore in the infrastructure and maritime sectors.

Award-winning, flexible and diverse solutions

We have a diverse range of products across the debt capital spectrum, including senior and mezzanine financing, fixed and floating rate instruments, project financing, asset-backed financing, acquisition financing, as well as loans and bonds.

Our financing solutions have helped Singapore companies break new ground in frontier markets such as Bangladesh and Myanmar, and facilitated the acceptance of new technological applications from Singapore such as floating liquefied natural gas (FLNG).

Our award-winning transactions are a testament of our innovative and flexible approach to financing in a manner that best suits our clients’ needs and requirements.

Competitive long-term funding

We offer our clients competitive long-term financing solutions, made possible through the support which we receive from the Singapore Government.

Global remit

Our global remit enables us to support our clients internationally which can be particularly helpful for Singapore-based companies venturing into distant markets. Our portfolio is spread across Asia, the Middle East, Africa, Europe and the Americas.

Commercially sustainable track record

Profitable since our second year, we have helped catalyse US$11.7 billion in overseas investments and US$8.2 billion in exports for Singapore-based companies since our inception in 2012.

Responsive and Experienced Leadership Team

With a lean organisation and an experienced, agile leadership team, we are able to enhance our clients’ competitiveness in the global arena

Our niche focus ensures that we have the bandwidth to understand the market and sectors in-depth and take lead structuring roles in our clients’ transactions when needed.

Qualifying Criteria

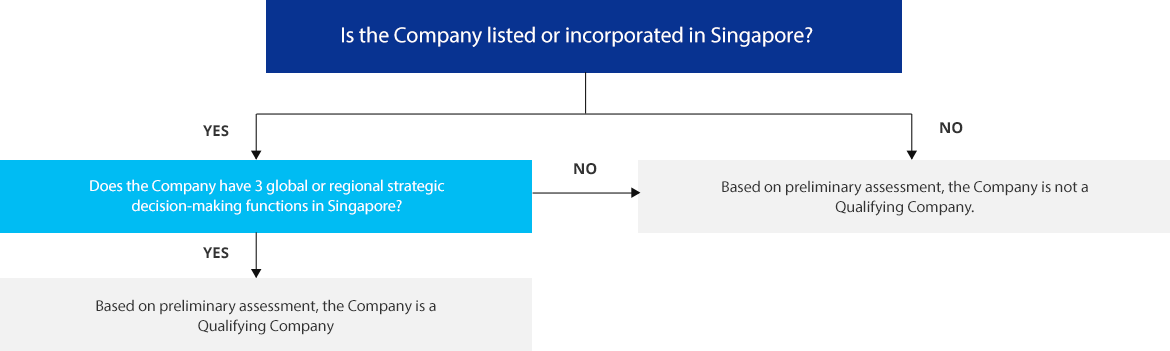

We aim to support Qualifying Companies in their exports to and investments in overseas markets.

A Qualifying Company is one that has a substantial presence in Singapore, with at least three global or regional decision-making functions based in the country. We will consider the number and profile of staff employed in each of these functions as part of our assessment.

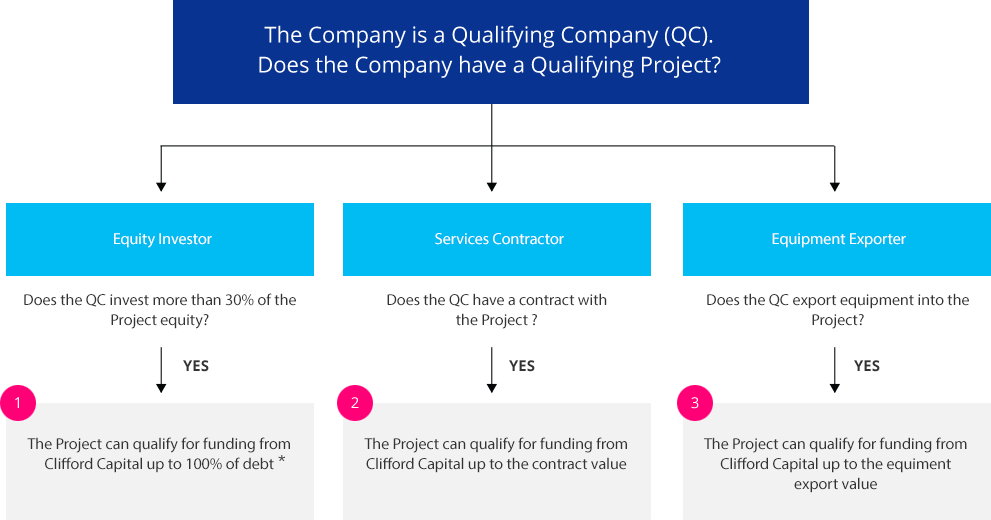

To determine if an export, asset or project is eligible for funding from Clifford Capital, we require certain qualifying criteria to be met.

* If the total project equity exceeds US$300 million, the minimum ownership threshold for the QC reduces to 10%

In each of the above cases, our financing amount may be further subject to any applicable constraints on individual ticket sizes.

We also consider projects that may not fully satisfy the conditions set out above on a case by case basis, taking into consideration the nexus to Singapore.